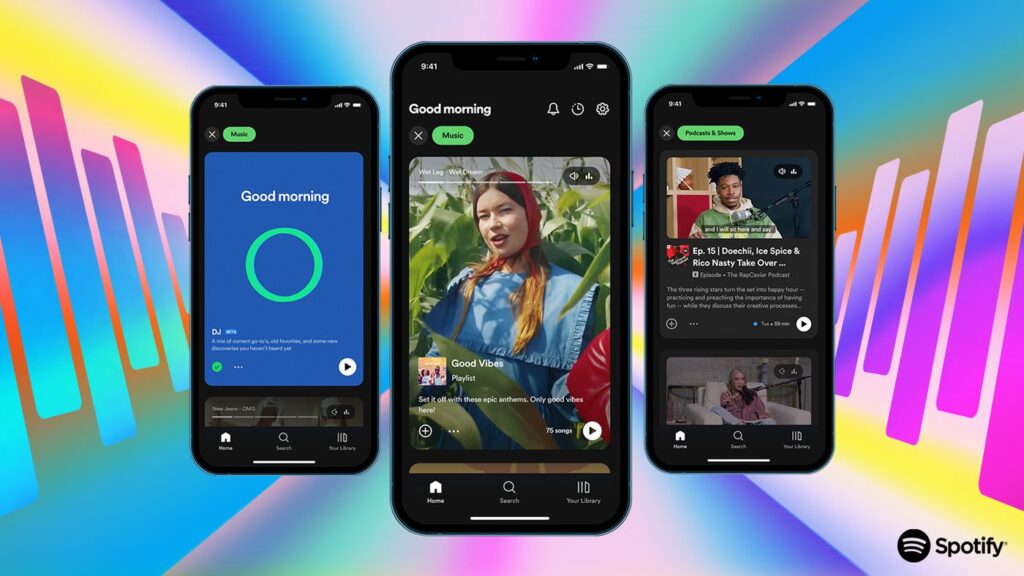

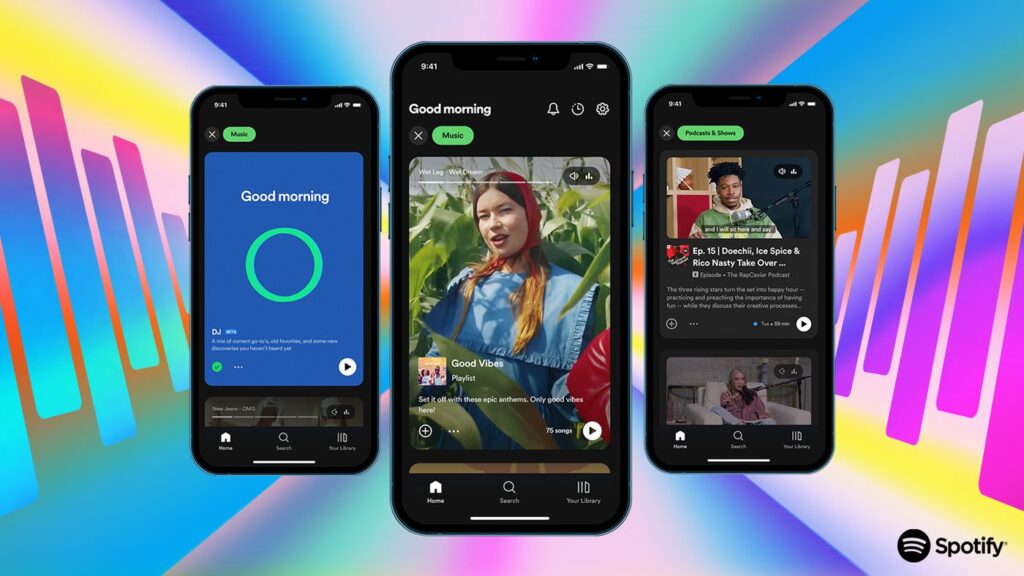

With over 400 million monthly active users and 220 million premium customers, Spotify is the most widely used music streaming service in the world, surpassing rivals like Apple Music and YouTube Music.

More than 70 million songs, podcasts, and other audio files from numerous genres and performers are accessible through it.

As a freemium service, Spotify offers restricted capabilities and ad-supported free listening, with the option to remove adverts for a monthly charge.

Daniel Ek and Martin Lorentzon, who intended to make a legitimate alternative to the widespread internet music piracy at the time, launched Spotify in Sweden in 2006.

They were successful in persuading the big record companies to provide Spotify a license to use their music libraries in exchange for a portion of the profits and business ownership.

After its 2008 introduction, Spotify quickly grew in popularity, notably after collaborating with Facebook in 2011. It grew to include numerous nations and launched its IPO in 2018 with a $26.5 billion valuation.

Spotify has never been profitable, despite being the leader in music streaming and having a devoted following.

Every year it has lost money, adding up to approximately $4 billion in losses by 2022. Additionally, since reaching a top of roughly $69 billion in February 2021, its stock price has fallen by more than 39%, to $27 billion.

One would anticipate Spotify to be quite wealthy considering how much it has impacted the music industry and the way we listen to music.

However, the truth is that Spotify continues to struggle with monetizing its music streaming service.

What obstacles does Spotify face in terms of generating revenue, then? And what actions is the business taking to address them?

These issues will be discussed, along with Spotify’s existing operations and prospects, in this article.

High Cost of Royalties

The major issue Spotify has is the exorbitant royalties it has to pay to the musicians whose music it streams.

Approximately two-thirds of every dollar Spotify earns from music streaming goes to the music’s rights holders, who include record labels, publishers, songwriters, and artists.

Only one-third of its earnings are now left over to pay for additional costs like marketing, administration, research and development, and taxes.

For Spotify, a third of its revenue is insufficient to even break even, let alone generate a profit.

So why does Spotify pay such a high percentage of its revenue in royalties? And why can’t it negotiate for lower rates since it’s a big market player?

The power disparity between Spotify and its music providers, specifically the large record companies in charge of the majority of the music streamed on Spotify, is the cause of this problem.

The majority of the music that Spotify streams is under license from the “Big Three” (Universal Music Group, Sony Music Entertainment, and Warner Music Group).

Together, The Big Three control 60% of the music publishing market and 70% of the music recording market, thereby creating an unholy monopoly over the sector.

In exchange for their assistance, artists give them the rights to their music to promote and distribute it.

They make the decisions on how much Spotify must pay them for streaming their music because of their considerable influence in the sector.

Spotify would lose subscribers to rivals like Apple Music, Amazon Music, or YouTube Music, all of which have licenses with The Big Three if it were unable to stream the millions of songs that its users want to listen to.

For Spotify, the choice of whether to include or exclude The Big Three’s music library is a matter of life or death.

As a result, Spotify has limited space for profit and is compelled to give The Big Three almost 70 cents of every dollar it earns.

Lack of originality is another issue with Spotify’s business.

Nowadays, you can simply find any song you want to listen to on any music streaming service you use, such as Spotify, Apple Music, etc.

It’s excellent for you as a customer to be able to listen to all of the music you enjoy in one location because the majority of the world’s music is accessible through all of the big streaming applications.

However, the music streaming businesses that operate them will suffer as a result.

Because there is nothing distinctive about anyone when all platforms offer the same material, there is no product distinction between them.

As music streaming gets commoditized and their revenue declines, pricing becomes their main point of competition.

The Difficulty of Owning Content

Possessing the content it broadcasts directly rather than obtaining a license to do so from third parties is one way Spotify might be able to boost its earnings.

When Netflix began making its original series and films, it did this to cut down on licensing costs and increase profitability.

The issue with Spotify, though, is that the record labels foresaw this move and forbade Spotify from ever owning music content and going up against them.

They stipulated clauses in their licensing agreements with Spotify that forbade Spotify from possessing the rights to work and only allowed its platform to broadcast it.

Due to these agreements, Spotify finds it very challenging to own music without going against the record labels’ restrictions, which might subject them to costly fines and possibly legal action.

The Big Three and Merlin, a group that represents independent companies, control more than 75% of the music that is streamed on Spotify, which gives them an excessive amount of power.

Due to legal action, Spotify was forced to discontinue within months of attempting to license music directly from artists in 2018, bypassing record labels.

The concentration of suppliers in each company’s particular industry serves as the primary differentiator between Spotify and Netflix.

The Big Three owns a 70% market share in the highly consolidated music recording industry.

In comparison, there were seven major film studios in the movie and television industry in 2012, the year when Netflix began creating its first original series, House of Cards, with the three biggest studios only controlling 45% of the market.

Compared to Spotify, this made it simpler for Netflix to bargain with its suppliers. It also made it possible for Netflix to purchase exclusive streaming rights from some studios, including Disney, for a set sum.

Netflix set itself apart from other services like Hulu and Amazon Prime Video with programming that was only available on its platform.

Spotify was forced to pay royalties based on its earnings as it was unable to obtain exclusive streaming rights.

The Gamble on Podcasts

Spotify must diversify outside of its main business of music streaming if it is to have any hope of being profitable.

For this reason, Spotify revealed its plan to switch from a music streaming service to an audio platform in 2019, with podcasts serving as one of the key motivators.

The primary justification for their choice was the fact that streaming podcasts was far less expensive than streaming music.

Outside of the region dominated by major record companies, Spotify may negotiate lower licensing costs in the podcasting industry.

Compared to the current 25–30% for music, Spotify believes that the long-term gross margin for podcasts is in the range of 40–50%.

Therefore, when Spotify’s audience consumes more podcasts, the percentage of overall revenue that is paid out in music royalties declines, increasing the company’s profit margins and potential.

Due to this, Spotify has made significant investments in the podcasting industry, paying over $1 billion to buy several audio businesses and securing exclusive contracts with well-known figures like Joe Rogan, Kim Kardashian, Prince Harry and Meghan Markle, and even the Obamas.

Podcasts lengthen people’s time streaming on Spotify, based on the company’s statistics.

Even though consumers’ time spent listening to music does slightly decrease as a result of podcasts, the additional time spent on podcasts more than makes up for it, resulting in an average 20% increase in total streaming time.

Theoretically, this tactic ought to increase Spotify’s earnings. But it’s not.

Financial data for Spotify show that this has not been the case thus far. The first half of 2023 has been even less lucrative than the same period in 2022, despite the corporation having earlier said that profitability was anticipated to improve in 2023. This is due to declining gross margin, operating margin, and net income margin.

Podcasts weren’t as lucrative as Spotify had first thought.

One potential justification? The money from Spotify’s podcasts is still insufficient to cover its obligations for music royalties.

Even though Spotify’s podcast audience has grown quickly, surpassing 100 million monthly active users in 2022, podcast revenue made up only 4% of the company’s overall revenue in that same year.

This indicates that a significant portion of Spotify’s revenue still comes from music streaming.

Additionally, advertising generates the majority of Spotify’s podcast revenue, which has lower margins than membership fees.

In 2022, Spotify’s revenue from advertisements had a gross margin of 18% as opposed to 28% for its premium revenue.

This means that even if Spotify’s podcast revenue increases more quickly than its music revenue, the company may still end up losing money.

Another explanation is that Spotify’s investments in podcasts are too costly and hazardous.

Spotify has invested over $1 billion in the acquisition of many audio companies and exclusive contracts with celebrities, but it’s possible that these investments won’t be profitable enough to cover their expenses.

The most well-known illustration of this is when Spotify paid $100 million to acquire the exclusive rights to stream The Joe Rogan Experience, one of the most well-liked podcasts in the whole globe.

Due to this agreement, the podcast had to be taken down from other websites, including Apple Podcasts and YouTube, where it had a sizable and devoted audience.

The potential reach and growth of new listeners who do not use Spotify were also hampered. This alienated some of the existing listeners who preferred to get the podcast through their preferred platforms.

Additionally, Spotify came under fire from some of its staff members and customers who disapproved of some of the contentious guests and viewpoints expressed on Joe Rogan’s program. Consequently, for Spotify and its audience, the podcast’s worth and appeal are diminished.

Additionally, other audio industry competitors are serious competitors to Spotify’s podcast strategy.

In addition to providing their own original and exclusive material, tools, and services for podcast makers and listeners, Apple, Amazon, and Google are also making significant investments in podcasts.

For instance, Apple recently introduced Apple Podcasts Subscriptions, a tool that enables podcasters to charge a monthly subscription for premium content that they choose to make available to their subscribers.

One of the biggest independent podcast producers in the world, Wondery, was purchased by Amazon to strengthen its Audible and Amazon Music platforms.

Podcasts are now easier for people to access and find because Google integrates them into its Google Search and Assistant platforms.

The dominance and uniqueness of Spotify in the podcast business may be threatened by these actions taken by its competitors.

The Unending Search for Profitability

Spotify’s leadership has constantly emphasized for years that the company prioritizes long-term growth over immediate profitability.

Spotify’s CEO, Daniel Ek, has frequently emphasized to investors that user growth is the most important indicator of future success.

Profit, though, is what matters in the end.

It is difficult to imagine Spotify making any significant profits any time soon given that podcasting has fallen short of expectations and that music streaming is unlikely to generate any revenue as long as The Big Three are still in existence.

To distract investors from its losses and buy time, Spotify executives will probably keep promoting the idea that user growth comes first.

However, in the absence of any significant adjustments that would increase revenue, it is only a matter of time before investors lose interest and Spotify runs out of cash, which could result in the sale of the business to one of its rivals.

In the meantime, however, Spotify may continue to take actions like layoffs or price increases, both of which we’ve seen recently in 2023.

In conclusion, it can seriously hinder any company’s ability to generate profits when suppliers have considerable bargaining power and rivals offer comparable goods. This is true even for a well-known software business like Spotify, which dominates the market for one of the hottest consumer fads of the day.